Corporate Governance

Basic Concept

The Shimamura Group believes that the basics of our business come from dealing fairly and equitably with

various stakeholders such as employees, customers, business partners, shareholders, and society.

We recognize that further strengthening the confidence and trust from stakeholders surrounding our business is

necessary for business continuity and growth. Furthermore, for that purpose, we recognize the importance of

enhancing corporate governance.

Moreover, in order to further increase management efficiency and profitability by developing and expanding the

unique business model that we have built in the retail industry, we believe that directors who possess

highly-specialized business and operational knowledge should decide on financial and business policies at the

Shimamura Group while complying with laws, regulations and the Articles of Incorporation, heighten corporate

value and contribute to the common interests of all stakeholders.

Corporate Governance Report

Corporate Governance Report submitted to the Tokyo Stock Exchange.

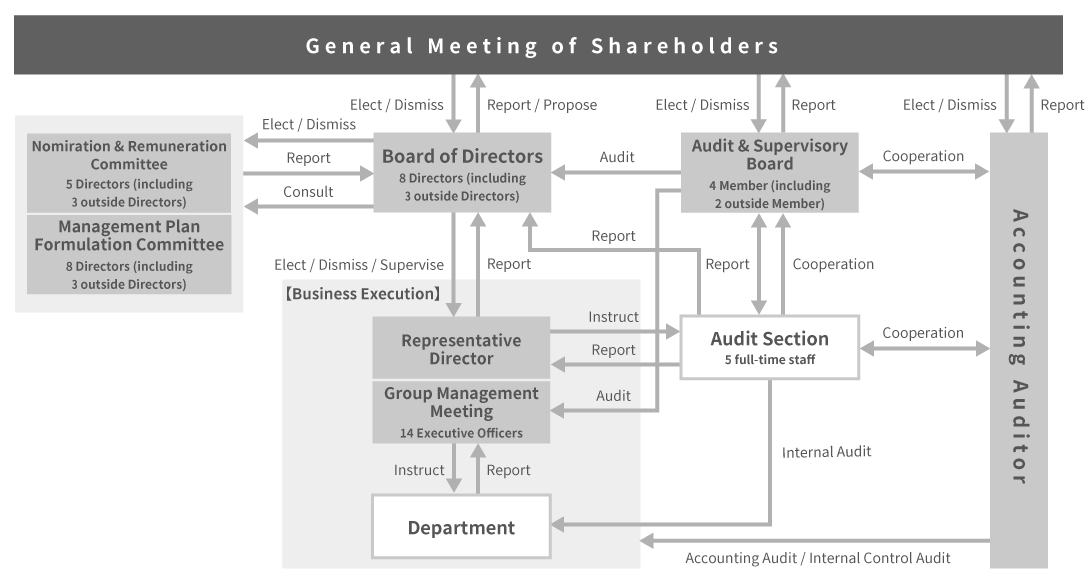

Corporate Governance System

(as of

May 19, 2025)

Overview

| Organizational Form | Company with the Audit & Supervisory Board |

|---|---|

| Chairman of the Board of Directors | Iichiro Takahashi, Representative Director, President and Executive Officer |

| Number of Directors | 8 (including 3 outside Directors and 1 female Director) |

| Number of Members on Audit & Supervisory Board | 4 (including 2 outside Audit & Supervisory Board members) |

| Number of Members on Nomination & Remuneration Committee | 5 Directors (including 3 outside Directors and 1 female director) |

| Number of Members on Management Plan Formulation Committee | 8 Directors (including 3 outside Directors and 1 female Director) |

| Frequency of the Board of Directors Meetings | At least once per month |

| Frequency of Group Management Meetings* | Once per week |

| Frequency of Audit & Supervisory Board Meetings | At least once per month |

| Independent Officers | 3 outside Directors and 2 outside Audit & Supervisory Board members |

| Accounting Auditor | KPMG AZSA LLC |

- *Group management meetings are held by executive officers to improve management efficiency and operation speed.

System Diagram

Information on Each Organization

- Board of Directors

- The Board of Directors consists of a total of 8 members: 5 inside Directors (5 of whom

concurrently serving as executive officers) and 3 outside Directors (independent officers). In order to

ensure accurate and prompt management decisions and transparency, a total of 17 meetings were held in

FY2024. In principle, at least one meeting was held per month.

Details of the deliberations by the Board of Directors

- Matters related to corporate policies

Medium/long-term management plans, annual business plans, important marketing policies, etc. - Matters related to a general meeting of shareholders

Convening general meetings of shareholders, matters to be discussed at the meetings, voting on agenda items, etc. - Matters related to financial results

Approval for financial statements and supplementary schedules - Matters related to Executives

Appointment and dismissal of the Representative Director, revision of the Regulations for the Board of Directors and the Regulations for Executive Officers, personnel affairs of Directors and Executive Officers, etc. - Matters related to shares and bonds

Issuance of new shares, stock split, Acquisition and disposal of treasury stock, interim dividends, the determination of the dividend amount, etc. - Matters related to personnel and organizations

Establishment or change of important organizational structures, adoption of proposals for awards and punishments, etc. - Matters related to business

Determination of an annual budget, conclusion of important management contracts, etc. - Matters related to assets

Acquisition, disposal, and renovation of important assets, leasing of large amounts of real estate, etc - Matters related to funds

Important investments and loans (excluding short-term fund management), determination and change of banks and other financial institutions financing the head office, etc. - Other

Appointment and dismissal of committee members, matters related to M&As, alliances, overseas business expansion, new business development, and other matters deemed necessary by the Board of Directors

- Matters related to corporate policies

- Group Management Meeting

- In principle, executive officers hold group management meetings once per week. A total of

48 meetings were held in FY2024. The purpose of these meetings is to improve management efficiency and

operation speed. The management meeting is chaired by the President and CEO, and is composed of inside

Directors and executive officers.

Details of the deliberations by the Group Management Meeting

- Matters of importance to be submitted to the Board of Directors

- Matters related to marketing policies

Annual departmental policies, priority issues, etc. - Matters related to personnel and organizations

Personnel affairs of General Managers and section chiefs, revisions to the organizational chart, establishment and revision of employment regulations and other important rules and systems, etc. - Matters related to personnel evaluation

Decisions on performance evaluation of General Managers and section chiefs, resolutions on proposed rewards and punishments, etc. - Matters related to labor policies

Basic labor policies, annual recruitment plans for new graduates, etc. - Other

Applications for new trademarks, etc. - Matters to be reported

Matters related to personnel and organizations, business, assets, etc.

- Matters of importance to be submitted to the Board of Directors

- Audit & Supervisory Board

- The Audit & Supervisory Board consists of two inside Audit & Supervisory Board

members (one standing Audit & Supervisory Board member) and two outside Audit & Supervisory Board

members (independent officers). The board holds meetings at least once a month, a total of 18 meetings

were held in FY2024.

Details of the deliberations by the Audit & Supervisory Board

- Selection and dismissal of full-time Audit & Supervisory Board members

- Establishment and review of the "Audit Regulations by the Audit & Supervisory Board"

- Planning of audits, methods of audits, and assignment of audit duties

- Matters related to the appointment of Audit & Supervisory Board members

Agreement with the submission of proposals by Directors to the general meeting of shareholders regarding the appointment of Audit & Supervisory Board members - Appointment of the Accounting Auditor

Deciding on proposals to be submitted to the general meeting of shareholders concerning the appointment, non-reappointment, or dismissal of the Accounting Auditor - Agreement with the determination of the remuneration of the Accounting Auditor by the Board of Directors

- Discussion regarding the remuneration of Audit & Supervisory Board members

To discuss and determine remuneration amounts within the total amount approved by the general meeting of shareholders, based on reasonable criteria - Adequacy of the execution of duties by Directors

- Legality of the business reports and supplementary schedules

- Internal control report from the Audit Section

Status of internal control reported by the Audit Section, which is an internal audit division

- Selection and dismissal of full-time Audit & Supervisory Board members

- Nomination & Remuneration Committee (voluntary committee serving as an advisory body to the Board of Directors)

- The Nomination & Remuneration Committee is composed of five members (two Representative Directors and three Outside Directors) selected by resolution of the Board of Directors, and meets at least four times a year in order to strengthen the fairness, transparency, and objectivity of procedures related to the nomination and remuneration of executive officers. The Committee met five times in FY2024.

Details of the deliberations by the Nomination & Remuneration Committee

- Matters related to the nomination of Executives

Proposals for executive officers, planning successor training, proposals for selecting representative directors, etc. - Matters related to the remuneration for Executives

Evaluation plans for Executive Officers and remuneration plans for Executive Officers and Directors, etc.

- Matters related to the nomination of Executives

- Management Plan Formulation Committee (voluntary committee serving as an advisory body to the Board of Directors)

- The Management Plan Formulation Committee is composed of members selected by a resolution

of the Board of Directors (total of 8 members, all of whom are Directors). In order to invigorate

discussions related to the formulation of Medium-Term Management Plans and annual management plans, and to

enhance the appropriateness, transparency, and objectiveness of the procedures, a total of 5 meetings were

held in FY2024. In principle, at least four times per year.

Details of the deliberations by the Management Plan Formulation Committee

- Matters related to medium/long-term management plans

Capital policy, human resources strategy, state of ESG progress, etc. - Matters related to annual management plans

Drafting fiscal year policies and numerical plans, revising performance forecasts as needed, etc.

- Matters related to medium/long-term management plans

-

Attendance at meetings in FY2024

Position in the Company Name Board of Directors

(Held 17 times)Audit & Supervisory Board

(Held 18 times)Nomination & Remuneration Committee

(Held 5 times)Management Plan Formulation Committee

(Held 5 times)Group Management Meeting

(Held 48 times)Number of meetings attended Attendance rate Number of meetings attended Attendance rate Number of meetings attended Attendance rate Number of meetings attended Attendance rate Number of meetings attended Attendance rate Representative Director,

Chairman and Executive OfficerMakoto Suzuki 17 100.0 - - 5 100.0 5 100.0 48 100.0 Director

Senior Executive OfficerIichiro Takahashi 17 100.0 - - - - 5 100.0 47 97.9 Director

Executive OfficerTakashi Nakahira 17 100.0 - - - - 5 100.0 47 97.9 Director

Executive OfficerYoshiteru Tsujiguchi 17 100.0 - - - - 5 100.0 48 100.0 Director

Executive OfficerHajime Ueda 17 100.0 - - - - 5 100.0 47 97.9 Director/

Senior AdvisorHidejiro Fujiwara

※116 94.1 - - 5 100.0 5 100.0 42 87.5 Director (outside) Tamae Matsui 17 100.0 - - 5 100.0 5 100.0 - - Director (outside) Yutaka Suzuki 17 100.0 - - 5 100.0 5 100.0 - - Director (outside) Teiichi Murokubo 17 100.0 - - 5 100.0 5 100.0 - - Standing Audit & Supervisory Board Member Masaaki Sato

※213 100.0 13 100.0 - - - - 36 97.3 Audit & Supervisory Board Member Hiroyuki Shimamura 17 100.0 18 100.0 - - - - 43 89.6 Audit & Supervisory Board Member (outside) Shigehisa Horinokita 16 94.1 17 94.4 - - - - - - Audit & Supervisory Board Member (outside) Teiichi Takatsuki

※213 100.0 13 100.0 - - - - - - Standing Audit & Supervisory Board Member Hideyuki Yoshioka

※34 100.0 5 100.0 - - - - 11 100.0 Audit & Supervisory Board Member (outside) Tetsuya Omi

※34 100.0 5 100.0 - - - - - - Senior Executive Officer Kazuo Konno

※4- - - - - - - - 46 95.8 Senior Executive Officer Masaaki Sato

※5- - - - - - - - 10 90.9 Executive Officer Shintaro Seki - - - - - - - - 47 97.9 Executive Officer Takeshi Nakamura - - - - - - - - 48 100.0 Executive Officer Tsuyoki Saito - - - - - - - - 46 95.8 Executive Officer Tatsuaki Hoshino - - - - - - - - 48 100.0 Executive Officer Makoto Oota - - - - - - - - 46 95.8 Executive Officer Kiyoshi Fujioka - - - - - - - - 48 100.0 Executive Officer Masao Isoyama - - - - - - - - 48 100.0

- ※ The positions for FY2024 are listed.

- ※1 Hidejiro Fujiwara retired from Director/Senior Advisor at the conclusion of the Annual General Meeting of Shareholders held on May 16, 2025.

- ※2 Masaaki Sato and Teiichi Takatsuki were elected and appointed at the Annual General Meeting of Shareholders held on May 17, 2024, and their attendance status listed here starts from their assumption of office.

- ※3 Hideyuki Yoshioka and Tetsuya Omi retired as of the conclusion of the Annual General Meeting of Shareholders held on May 17, 2024, and their attendance status listed here is up to the time of their retirement.

- ※4 Kazuo Konno retired as Senior Executive Officer on February 20, 2025.

- ※5 Masaaki Sato resigned as Senior Executive Officer on May 16, 2024, and his attendance status listed here is up to the time of his resignation.

Maintenance of Internal Controls System

At the same time as being a sincere and good company for our stakeholders, the Shimamura Group has defined the Internal Controls Regulations to maintain an organizational structure which continuously improves while establishing an internal controls system stipulated by the Companies Act and the Financial Instruments and Exchange Act.

Basic Policy for the Internal Controls System PDF

Criteria for Nominating Officers

- Criteria for Nominating Director Candidates

-

Candidates for members of the Board of Directors of the Shimamura Group are those who satisfy the following criteria and are deemed as possessing the knowledge, ability, and experience for contributing to the realization of our philosophy as members of the Board of Directors. After deliberation by the Nomination & Remuneration Committee, nominations will be made in accordance with a resolution of the Board of Directors.

Furthermore, at least three candidates for outside Directors will be nominated from among candidates who satisfy the requirements for outside Directors as defined in the Companies Act, and who satisfy criteria (5) as listed below in place of criteria (4).- Possess the strong will and high ability necessary to execute the duties of a Director.

- Possess the appropriate personality and insight as a Director of the Shimamura Group.

- Be capable of securing the time and effort necessary to properly fulfill the roles and responsibilities required of a Director of the Shimamura Group.

- Possess the knowledge, ability, and extensive experience for contributing to the formulation and execution of the Group's management strategy based on a deep understanding of the Group's business and management environment.

- Possess a high level of expertise or abundant experience in corporate management, academics, financial accounting, law and other fields. Recognized as being capable of executing duties from an independent and objective point of view.

- Criteria for Nominating Audit & Supervisory Board Member Candidates

-

Candidates for members of the Audit & Supervisory Board of the Shimamura Group are those who satisfy the following criteria and are deemed as being able to contribute to the realization of our philosophy through the execution of their duties as members of the Audit & Supervisory Board. After receiving agreement from the Audit & Supervisory Board, nominations will be made in accordance with a resolution of the Board of Directors.

Furthermore, more than half of the candidates for outside Audit & Supervisory Board members will be nominated from among candidates who satisfy the requirements for outside Audit & Supervisory Board members as defined in the Companies Act, and who satisfy criteria (5) as listed below in place of criteria (4).- Possess the strong will and high ability necessary to execute the duties of an Audit & Supervisory Board member.

- Possess the appropriate personality and insight as an Audit & Supervisory Board member of the Shimamura Group.

- Be capable of securing the time and effort necessary to properly fulfill the roles and responsibilities required of an Audit & Supervisory Board member of the Shimamura Group.

- Possess the knowledge, ability, and experience for auditing in the Group based on a deep understanding of the Group's business and management environment.

- Possess a high level of expertise or abundant experience in corporate management, academics, financial accounting, law and other fields.

- Criteria for Nominating Outside Directors and Outside Audit & Supervisory Board Members

-

-

Independence

The Group recognizes the independence of persons to whom none of the following items apply.

- 1) A person who is currently an executive of the Group or its subsidiaries, or had been an executive during the past ten years ("executive" as defined in Article 2, Paragraph 3, Item 6 of the Regulation for Enforcement of the Companies Act. The same applies in the following criteria).

- 2) A person for whom the Group is a main business partner, or an executive at a company for whom the Group is a main business partner. (Note)

- 3) Main business partners of the Group, or executives at main business partners of the Group. (Note)

- 4) In addition to officer remuneration from the Shimamura Group, a consultant, accounting expert, or legal expert who has received money or other property of 10 million yen or more in that person's most recent business year. (If the party who has obtained the money or other property is a corporation or organization, a person who belongs to the corporation/organization which obtains more than 2% of its net sales or total income from the Shimamura Group.)

- 5) A person to whom any of the items from 2) to 4) above has applied in the past 3 years.

- 6) A person who substantially holds 10% or more of the voting rights of the Group, or an executive at a company which holds 10% or more of the voting rights.

- 7) Spouse and relatives within the second degree of kinship to persons listed in any of the items from 1) to 6) above.

(Note) "Main business partners" are those whose transaction amount in the most recent business year accounts for 2% or more of the annual sales of the Group or the business partner.

-

Term of office

- 1) The maximum term of office for outside directors is basically 10 years.

- 2) The maximum term of office for outside Audit & Supervisory Board members is basically eight years (two terms).

-

Independence

Skills to Expect from the Board of Directors

| Name | Company Management |

Product, Marketing |

DX, IT | Finance, Accounting |

Legal, Compliance, Risk management |

organization, Human resources |

ESG |

|---|---|---|---|---|---|---|---|

| Makoto Suzuki | ○ | ○ | ○ | ○ | ○ | ○ | |

| Iichiro Takahashi | ○ | ○ | ○ | ○ | |||

| Takashi Nakahira | ○ | ○ | ○ | ||||

| Yoshiteru Tsujiguchi | ○ | ○ | ○ | ||||

| Hagime Ueda | ○ | ○ | ○ | ||||

| Tamae Matsui | ○ | ○ | ○ | ○ | ○ | ||

| Yutaka Suzuki | ○ | ○ | ○ | ○ | ○ | ||

| Teiichi Murokubo | ○ | ○ | ○ | ○ | ○ |

Status of Outside Officers

(as of

May 19, 2025)

| Position | Name | Role | Main Background |

|---|---|---|---|

| Director | Tamae Matsui | Possesses extensive experience and insight in the fields of personnel policy, employee welfare, and

social/environmental sustainability in the retail industry. Provides advice and recommendations based

on that experience from an independent perspective outside of the Shimamura Group. Member of the Nomination & Remuneration Committee and the Management Plan Formulation Committee. |

Seiyu GK Executive SVP |

| Director | Yutaka Suzuki | Possesses extensive experience and deep insight as a corporate manager. Provides useful advice and

recommendations for Group management from an independent perspective outside of the Shimamura

Group. Member of the Nomination & Remuneration Committee and the Management Plan Formulation Committee. |

Kewpie Corporation President and CEO |

| Director | Teiichi Murokubo | In addition to the deep knowledge relating to finance and accounting based on experience over many

years in financial institutions, he has held positions such as Executive Director of Saitama

Association of corporate Executives and has extensive insight into corporate management. Accordingly,

we have appointed him as an outside executive because we have judged that he can provide advice and

proposals based on that experience from an independent perspective outside our company. Member of the Nomination & Remuneration Committee and the Management Plan Formulation Committee. |

Served as Branch Manager and Department Head at Saitama Resona Bank, Limited Executive Director of Saitama Association of corporate Executives |

| Auditor | Shigehisa Horinokita | Possesses expertise in corporate finance as a CPA. Provides advice and recommendations regarding the strengthening of the Group audit system based on his experience and insight from an independent perspective outside of the Shimamura Group. | KPMG AZSA LLC Representative Employee |

| Auditor | Taiichi Takatsuki | Possessing experience in accounting and other related fields at other companies and experience as an Audit & Supervisory Board member, he has a wealth of insight and expertise, which he uses to provide advice on ensuring the appropriateness and fairness of decision-making by the Board of Directors. | World Co.,Ltd. Director(Audit & Supervisory Committee Member) |

- *All Five outside officers have been notified to the Tokyo Stock Exchange as independent officers.

Message from Outside Directors

-

Outside DirectorTamae Matsui

- What is your role as an Outside Director?

- Shimamura's family-like corporate culture, sincere approach to work, and high level of employee

loyalty make Shimamura a remarkable company that truly deserves to be recognized as a "good company."

I also admire the fact that the company has continued to grow for a long time by steadily pursuing its

business centered on apparel while sparing no effort to evolve further. However, we are now in an era

of instability where anything can happen, including world affairs, and there is no guarantee that we

can even protect the status quo if we do not discern the truth amidst the flood of information and

manage our business with a sense of crisis.

I am strongly convinced that now is the time for all Executives, both from outside and inside the company, to work together to protect the company and aim for further growth. With a heightened sense of resolve, we are committed to honing our abilities to make swift and astute decisions and fearlessly implementing transformative reforms. While ensuring the active discussions and improving effectiveness of the Board of Directors remains paramount, I firmly believe that it is essential to nurture managers who can lead management with a broader perspective than ever before. With a profound sense of ownership and unwavering determination, I am committed to fulfilling my role in this endeavor.

-

Outside DirectorYutaka Suzuki

- What is your role as an Outside Director?

- We are pursuing management that can sustainably gain the support of our customers and realize the growth and happiness of our employees. The key to the sustainable and sound development of the Shimamura Group is to utilize the wisdom of the employees working with us to deliver a wide range of products and services that will please our customers. The sweat and hard work that generate that wisdom is the basis for our growth, and the results of that growth will create our valued customers. We believe that a company exists only if it has a business that is supported by its customers, and our mission is to devote ourselves to the creation of people, organizations, and satisfaction in order to make our company respected and trusted by our customers.

-

Outside DirectorTeiichi Murokubo

- What is your role as an Outside Director?

- The skills expected of me are in the areas of corporate management, finance and accounting, legal,

compliance and risk management, organization and human resources, and ESG. I provide advice and

recommendations on a case-by-case basis, drawing on the knowledge, experience, and personal networks I

have gained over the past 30 years working for financial institutions and 15 years working for

economic organizations. Last fiscal year, I expressed my opinions on various matters, particularly on

the development of risk management systems and the promotion of ESG response.

Maintaining my independent position from the executive team, I will continue to supervise management and strive to contribute to Shimamura's sustainable growth and enhancement of corporate value. The basis of Shimamura's corporate governance is to deal with stakeholders fairly and justly, and I will continue to value communication with everyone.

Officer Remuneration

- Basic Policy of Officer Remuneration

-

- Remuneration shall emphasize the link between business performance and medium- to long-term corporate value, and that value shall be shared with shareholders.

- The level should be appropriate for the roles and responsibilities of officers.

- We will ensure fairness, transparency, and objectivity through deliberation by the Nomination & Remuneration Committee, the majority of which is composed of outside Directors.

- Officer Remuneration System and Remuneration Determination Procedures

- Officer remuneration is composed of three types: Basic remuneration, which is a fixed remuneration, bonuses as short-term incentive remuneration (executive officers), and stock compensation as medium- to long-term incentive remuneration (executive officers; scheduled to be introduced this fiscal year).

- Director Remuneration

- Only the basic remuneration is paid. Within the total amount approved at the general meeting

of shareholders, the President shall draft an appropriate standard, and a final decision is made by the

Board of Directors after deliberation by the Nomination & Remuneration Committee.

*The maximum amount of remuneration for Directors shall be 400 million yen per year (per a resolution passed at the 62nd Annual General Meeting of Shareholders held on May 14, 2015). - Remuneration for Audit & Supervisory Board Members

- Only the basic remuneration is paid. Within the total amount approved at the general meeting

of shareholders, a final decision is made based on deliberation by Audit & Supervisory Board members per

valid criteria.

*The maximum amount of remuneration for Audit & Supervisory Board members shall be 94 million yen per year (per a resolution passed at the 55th Annual General Meeting of Shareholders held on May 16, 2008). - Executive Officer Remuneration

- In addition to the basic remuneration, executive officer remuneration consists of

performance-linked bonuses based on company performance for each business year and restricted stock

compensation (introduce in FY2021). The total amount of payment and the amount of payment for each

individual are drafted by the President in accordance with the Executive Officer Regulations. A final

decision is made by the Board of Directors after deliberation by the Nomination & Remuneration

Committee.

Monthly compensation, which is basic compensation, is revised in April each year in principle based on the performance evaluation of executive officers for the previous year.

The restricted stock compensation is by having executive officers own shares of the Group, we seek to clarify the system for linking the remuneration of executive officers and the stock value. We also strive to achieve sustainable growth and to increase corporate value in the medium- to long-term by further promoting the sharing of value with shareholders.

In addition, the Group's directors basically serve concurrently as executive officers. - Compensation configuration ratio

-

Basic remuneration (fixed) Incentive remuneration Bonus Stock compensation Director who concurrently serves as executive officer 79% 12% 9% Outside Directors / Senior Advisor 100% - - Executive Officers 75% 15% 10% - Guidelines for Holding Treasury Shares

- We have established Guidelines for Holding Treasury Shares for officers (directors, executive officers, and Audit & Supervisory Board members). These guidelines establish restrictions on the acquisition and sale of treasury shares.

Evaluating the Effectiveness of the Board of Directors

The Group conducts a questionnaire-based survey of Directors and Audit & Supervisory Board members once

per year in order to evaluate the effectiveness of the Board of Directors.

The Secretariat of the Board of Directors reports the analysis results of the survey to the Board of

Directors. Then, after deliberating on issues and countermeasures, efforts are made to improve the

effectiveness of the Board of Directors by making the necessary improvements.

- [Implementation content]

-

Evaluation target: Board of Directors meetings held in FY2023 (March 2023 to February 2024) (total of 17 meetings) Evaluator: 9 Directors and 4 Audit & Supervisory Board members (13 in total) Implementation period: March 2024 - [Evaluation process]

-

-

The President and the Secretariat (Planning Section) of the Board of Directors prepare a questionnaire

on the effectiveness of the Board of Directors.

(Main items on the questionnaire)

- 1) Composition of the Board of Directors

- 2) Operation of the Board of Directors

- 3) Agenda of the Board of Directors

- 4) Systems for supporting the Board of Directors

- Questionnaires collected from Directors (9) and Audit & Supervisory Board members (4)

- Aggregation and analysis of survey results by the Secretariat of the Board of Directors; reporting of results to the Board of Directors

- Deliberation by the Board of Directors

-

The President and the Secretariat (Planning Section) of the Board of Directors prepare a questionnaire

on the effectiveness of the Board of Directors.

- [Measures to improve effectiveness]

-

- Issue 1.

Discussion of risk management is still lacking. -

[Countermeasures]Risk management rules were substantially revised and disclosed in FY2024.

- Issue 2.

There is a lack of in-depth discussion on growth strategy and how to embody it. -

[Countermeasures]We formulated our Medium-term Management Plan 2027, and announced it in FY2024. We decided to continue discussing our growth strategy.

- Issue 3.

Discussion on human resources strategy is lacking. -

[Countermeasures]We formulated our Medium-term Human Resources Strategy 2027, and announced it in FY2024.

We also discussed our succession plan for the company president.

We decided to continue discussing our human capital.

- Issue 1.

Cross-Shareholding

(as of February

20, 2025)

The Group engages in cross-shareholding at the discretion of the Board of Directors when there is a need for

business alliances, building and maintaining business relationships with important business partners, or other

business activities aimed at sustainable growth.

For individual instances of cross-shareholding, the Board of Directors conducts an annual review for the

rationality and economic rationality of the purpose of cross-shareholding. This review includes confirming the

purpose of holding, transaction status, latest business results, and future transaction prospects, as well as

consideration for selling when the purpose of holding no longer exists.

| Number of Stock Names | Amount listed on Balance Sheet | |

| Listed stocks | 4 stock names | 857 million yen |

| Unlisted stocks | None | - |