Environment

Climate change initiatives ―

Disclosures based on the TCFD recommendations

The Shimamura Group believes that responding to climate change is an important management issue.

Accordingly, we are promoting our own reasonable initiatives to reduce greenhouse gases.In addition, we have

endorsed the TCFD recommendations and we disclose our efforts for them in line with the four disclosure

items of the TCFD, so that institutional investors who perform ESG investment can make appropriate

investment decisions.

*The TCFD recommendations endorse disclosures in line with four information disclosure items: governance,

strategy, risk management, and metrics and targets.

-

1 Governance

-

- Role of the Board of Directors

-

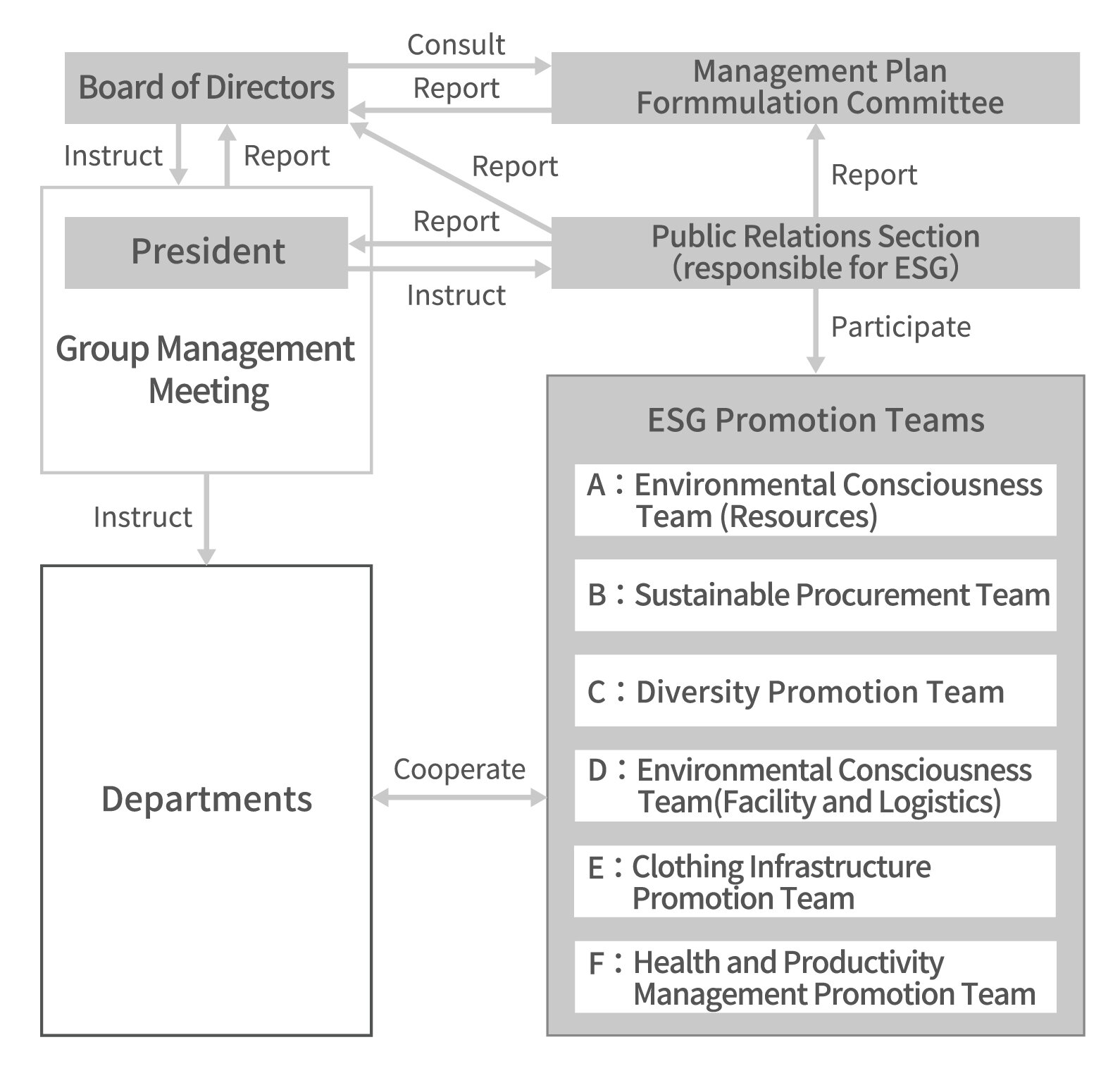

ESG policies are determined by the Board of Directors following deliberations by the Management Plan Formulation Committee, a eight-member committee entirely composed of directors that acts as an advisory body to the Board of Directors. To us, ESG issues are management issues. This is why the Management Plan Formulation Committee, which is tasked with discussing management plans, also deliberates upon ESG issues.

At least twice a year, the Board of Directors receives reports on the efforts of each department and each ESG Promotion Team as well as any results. It then monitors and supervises progress. The Board of Directors also makes decisions on important matters such as ESG-related management strategies and management planning.

- Role of the Management Committee

- The policies determined by the Board of Directors are communicated to each department and are then incorporated into their respective policies. Moreover, the ESG Promotion Teams, in which executive officers participate, deliberate on policies that should be tackled across department lines and then proceed with their implementation in cooperation with each department. As a general rule, each ESG Promotion Team meets once a month, and the outcomes of these meetings are reported to the President by the Public Relations Section. The teams then receive instructions from the President as necessary.

- ESG Promotion System

-

-

2 Strategy

-

- Scenario analysis

-

Climate change risks include transition risks brought about by changes in policies, laws and

regulations and physical risks such as damage to property due to an increase in natural

disasters.

We conducted scenario analysis to identify the impact major risks and opportunities relating to climate change will have on our business and to then formulate strategies to respond to that.

We conduct the scenario analysis according to the following process.1 The Public Relations Section, which is responsible for ESG, conducts scenario analysis. 2 The Public Relations Section then reports the scenario analysis results to the Board of Directors. 3 The Board of Directors deliberates the results and then makes a decision. 〈Prerequisites of scenario analysis〉

-

1.Scenario used

International Energy Agency(IEA)

WEO 2024Intergovernmental Panel on Climate Change(IPCC)

the Sixth Assessment ReportDecarbonization scenario

(1.5℃~2℃)NZE(Net Zero Emissions by 2050 Scenario)

SSP1-1.9,SSP1-2.6 Climate change progression

(2.7℃~4℃)STEPS(Stated Policies Scenario) SSP3-7.0,SSP5-8.5 - 2.Analysis target

Domestic business -

3.Assumed period

Short-term ~2027.2(Period of the Medium-Term Management Plan) Medium-Term ~2030.2(Period of the Long-Term Management Plan) long-term ~2050

〈World view assumed in the scenario analysis〉

*The temperature assumed in the scenario is the average rise in temperature by 2100. Decarbonization scenario

(1.5℃~2℃)Laws and regulations A carbon tax and strict laws and regulations are imposed to achieve decarbonization. Energy prices Electric power prices rise as the shift from fossil fuels to renewable energy advances. Natural disasters Natural disasters become more frequent and severe in the short- to medium-term.

The intensification of natural disasters then comes to a halt in the long-term compared to the global warming scenario.Global warming progress scenario

(2.7℃~4℃)Laws and regulations The impact would be minor even if current laws and regulations continue and a carbon tax is introduced. Energy prices Crude oil prices rise due to the continued dependence on fossil fuels. Natural disasters Natural disasters become more frequent and severe over the longer term.

The frequency of occurrence and damage from natural disasters are greater than in the decarbonization scenario. -

1.Scenario used

- Major Risks and Opportunities Identified Related to Climate Change

-

Classification Major Changes

(Time Period)Description Level of impact 1.5~2℃ 2.7~4℃ Transition

risksPolicy and

regulationIntroduction of a carbon tax and GHG restrictions (short-long term) Increase in product procurement costs as a result of rising raw material prices and logistics costs due to an increase in taxes and energy prices very large Large Increase in operational costs for store and Transfer Center operations (heating and lighting, etc.) due to higher taxes and energy prices very large Large Increase in product procurement costs as a result of a change to raw materials and packaging materials due to laws and regulations on materials with a high environmental burden very large Large Reputation Delays in addressing environmental issues (short-long term) Fall in reputation among stakeholders due to delayed response to environmental issues very large Large Transition

opportunityProduct and Service Changes in consumer behavior (short-long term) Increase in opportunities to sell environmentally-friendly products due to the heightened awareness of consumers toward sustainability very large Large Physical

RiskAcute risks Increase in natural disasters caused by typhoons and heavy rains (short-long term) Loss of sales opportunities due to a suspension of sales at stores in disaster-affected areas Large very large Disruptions to the product supply structure due to a suspension of operations at transfer centers in disaster-affected areas Large very large Increase in repair costs for stores and transfer centers due to damage to buildings in disaster-affected areas Large very large Chronic risks Rise in average temperatures (short-long term) Increase in product procurement costs due to a decrease in agricultural produce yield Large very large Loss of sales opportunities due to the reduced purchasing motivation for winter products as summers become longer and winters become shorter Large very large Unstable precipitation(short-long term) Increase in product procurement costs due to a decrease in agricultural produce yield Large very large

- Financial impact on our company (assumed in 2050)

-

Introduction of a carbon tax Decarbonization scenario

(1.5℃~2℃)3,788 million yen

*Carbon tax250US$/t-CO2(NZE)

*GHG emissions(FY2024・Scope1,2):99,612t-CO2Climate change progression

(2.7℃~4℃)2,394 million yen

*Carbon tax:158US$/t-CO2(STEPS)

*GHG emissions(FY2024・Scope1,2):99,612t-CO2Losses from disasters Decarbonization scenario

(1.5℃~2℃)112million yen

*1.5 times the disaster rate compared with pre-Industrial Revolution level

(SSP1-1.9,SSP1-2.6)

*Loss on disaster(average 2015-2024):97 million yenClimate change progression

(2.7℃~4℃)203 million yen

*2.7 times the disaster rate compared with pre-Industrial Revolution level

(SSP3-7.0,SSP5-8.5)

*Loss on disaster(average 2015-2024):97 million yen

- Response Strategy

-

Major risks and opportunities Countermeasures Risk Increase in procurement costs - ・Diversify risks by diversifying and decentralizing countries of production and suppliers (manufacturers, trading companies, and other companies from which we obtain products; approximately 600 companies)

- ・Take early measures in cooperation with suppliers (early reservation of materials and changes to alternative materials) to ensure procurement of raw materials

Increase in logistics costs - ・Streamline logistics via in-house operation of Transfer Centers, in-house joint delivery, and direct logistics

Increase in heating and lighting costs - ・Introduction of equipment to reduce power consumption (switching to LED lighting and energy-saving air conditioners)

- ・Develop sustainable stores (introduce energy-saving equipment and increase the use of heat shielding and heat insulating materials)

Loss of sales opportunities of winter products - ・Motivate customers to make purchases for reasons besides the weather or temperature by enhancing ability to plan and propose trendy products and products featuring popular characters

Loss of sales opportunities due to a suspension of store operation - ・Diversify risk through multi-store expansion (currently approximately 2,200 stores in operation)

- ・Maintain business continuity plans (BCPs) that detail the systems and measures required to restore business

Disruptions to the product supply structure due to a suspension of operations at transfer centers - ・Maintain business continuity plans (BCPs) that detail systems and measures such as delivery routes in the event of a disaster

Increase in repair costs due to building damage - ・Maintain business continuity plans (BCPs) that detail the systems and measures required to repair and restore buildings

- ・Consult hazard maps and similar resources as part of the store development process

- ・Implement measures against disasters such as installing water barriers in stores susceptible to flooding

Delays in addressing environmental issues - ・Promote a circular economy for resources such as hangers and plastic bags

- ・Continue promoting zero product disposal via product collection and recycling

Opportunity Increased sales opportunities for sustainable products - ・Ramp up efforts to develop and promote the sale of sustainable products

-

3 Risk Management

- The Public Relations Section, which is responsible for ESG, holds discussions with departments which may face business risks in the future and each ESG Promotion Team. Upon that, it works to understand the situation relating to risks and opportunities and reports its findings to the Management Plan Formulation Committee. The Management Plan Formulation Committee then deliberates upon any policies selected to respond to major risks, after which the Board of Directors determines them.

-

4 Metrics and Targets

-

- Climate change evaluation indicators and targets

-

We have established the following indicators to manage climate-related risks and opportunities.

1 GHG emissions(Scope1+2)(*1) 60% reduction compared to FY2013 by FY02/2027 2 Amount of excess inventory wastes zero 3 Complete recycling ratio of designated color hangers(*2) 90% in FY2/2027 4 Complete recycling ratio of designated plastics (*3) 50% in FY2/2027 5 Ratio of sustainable products(*4)

40% in FY2/2024 - *1 Scope 2 is location-based

- *2 Plastic hangers in the Company's designated colors that come with products (hangers which are used repeatedly as fixtures do not count.)

- *3 Transparent plastic for product protection used at the time of delivery (made of polypropylene)

- *4 Ratio of sustainable products among private brand products.

Water and land are also included in the climate change evaluation indicators. However, we are in the retail industry. Accordingly, we have a small impact on water and soil pollution. Therefore, we have not counted them in the evaluation indicator.

- GHG(Greenhouse Gas)emissions

-

〈Scope1,2〉

(Scope)FY 2013 2019 2020 2021 2022 2023 2024 Scope1 2,899 652 561 763 775 744 764 Scope2

Location-based180,956 104,532 102,212 99,314 96,170 96,971 95,131 Scope2

Market-based163,883 106,142 104,711 103,049 98,619 99,737 98,848

Scope1 : Kerosene, gas and other fuels for air conditioners, fuel for forklifts used at transfer centers

Gasoline consumption in company-owned cars (Gasoline consumption of company-owned cars is not included before FY2020.)

Scope2 (Location Standard): Electricity for stores, transfer centers and the Head Office x National average coefficient

Scope2 (Markets Standard): Adjusted emission factor

(Specified business operator periodic reports in the Act on the Rational Use, etc. of Energy, Excluding Scope1)

-

〈Scope3〉

We performed a Scope 3 calculation to identify what categories are important among the 15 Scope 3 categories.

There are many companies related to the supply chain (even primary product suppliers alone: approximately 600). Accordingly, we have used a simple calculation which uses the emissions intensity and expenditures cited from the Ministry of the Environment's emission intensity database and IDEAv2 instead of an incremental formula (fact-finding survey based on interviews with related-supply chain).Category 2023

Emissions2023

Composition ratio2024

Emissions2024

Composition ratio1:Purchased products and services 2,476,283 93.2 2,491,434 91.9 2:Capital goods 20,222 0.8 32,491 1.2 3:Activities related to fuel and energy not included in Scope 1 and 2 15,268 0.6 15,506 0.6 4:Upstream transportation and distribution 54,237 2.0 81,634 3.0 5:Waste generated in operations 2,894 0.1 3,188 0.1 6:Business trips 5,146 0.2 5,635 0.2 7:Employee commuting 16,969 0.6 17,093 0.6 8:Upstream leased assets - - - - 9:Downstream transportation and distribution - - - - 10:Processing of sold products - - - - 11:Use of sold products - - - - 12:End-of-life treatment of sold products 65,923 2.5 65,581 2.4 13:Downstream leased assets - - - - 14:Franchises - - - - 15:Investments - - - - Scope3 Total 2,656,942 100.0 2,712,562 100.0 -

Category Explanation of the calculation method and non-applicable cases 1:Purchased products and services - ・Calculation targets:Products (clothes, bedding, other textile products, shoes, bags, etc.), office supplies, fixtures and furnishings

- ・Calculation method:Quantity or monetary amount of purchased products × Emissions intensity

2:Capital goods - ・Calculation targets:Buildings, structures, ancillary equipment, machinery and vehicles

- ・Calculation method:Monetary amount of capital goods × Emissions intensity

3:Activities related to fuel and energy not included in Scope 1 and 2 - ・Calculation targets:Fuel and electric power purchased and used

- ・Calculation method:Amount of fuel and electric power purchased × Emissions intensity

4:Upstream transportation and distribution -

・Calculation targets:

- ①Transportation of products from overseas factories to our transfer centers (transportation by other companies and consignor: other companies)

- ②Transportation of products from our transfer centers to stores (transportation by other companies and consignor: our company)

-

・Calculation targets:

- ①Distance between the overseas port and domestic port with a large purchase composition rate × Amount of cargo (estimate from the amount purchased) × Emissions intensity

- ②Use of specified consignor periodic reports in the Act on the Rational Use, etc. of Energy

5:Waste generated in operations - ・Calculation targets:Waste generated from our business

- ・Calculation method:Waste disposal expenses × Emissions intensity

6:Business trips - ・Calculation targets:Employee business trips

- ・Calculation method:Traveling expenses and accommodation expenses × Emissions intensity

7:Employee commuting - ・Calculation targets:Employee commuting

- ・Calculation method:Traveling expenses × Emissions intensity

8:Upstream leased assets - Not applicable because it is subject to the calculation for Scopes 1 and 2.

9:Downstream transportation and distribution - Not applicable because emissions associated with the operation of transfer centers are Scopes 1 and 2, and transportation from transfer centers to stores is category 4.

10:Processing of sold products - Not applicable because we do not handle intermediate products.

11:Use of sold products - It is necessary to wash and dry the clothes we sell. However, this is not applicable because no scenario has been established in industry groups.

12:End-of-life treatment of sold products - ・Calculation targets:Products sold

- ・Calculation method:Monetary amount of products sold × Emissions intensity

13:Downstream leased assets - Not applicable because it is subject to the calculation for Scopes 1 and 2.

14:Franchises - Not applicable because we do not operate franchises.

15:Investments - Not applicable because we are not a financial institution.

- Initiative for reduce GHG emissions

-

〈In-house efforts〉

-

Reduction of power consumptionScope2

Energy saving of air conditioners

The Shimamura Group is working to reduce power consumption and CO2 emissions by replacing conventional air conditioning equipment with high energy-saving air conditioning equipment when opening new stores or remodeling stores.

Switch to LED lightingWe are working to save energy (reduce CO2) by changing from conventional lighting to LED lighting. With the exception of some stores, the switch to LED lighting has been completed at stores and transfer centers.

Promotion of environmental consciousness in stores and transfer centersWe are conducting research and development of sustainable stores into which we will introduce energy-saving equipment to further reduce the CO2 emissions from our stores and transfer centers.

-

Reduction of GHG emissions in in-house logisticsScope3

Category4

Increasing the efficiency of logisticsAt transfer centers, we have introduced a mechanism of "in-house joint delivery." In this mechanism, packages delivered from multiple suppliers are put on trucks chartered by the Shimamura Group, and are delivered to each store. In this way, we are working to increase the efficiency of truck delivery routes and to improve the loading rate. We started introducing EV trucks on some delivery routes to reduce CO2 emissions from 2022.

We are also striving to reduce CO2 emissions throughout overall logistics in Japan by using "direct logistics," in which containers transported from overseas to Japan are delivered directly to our transfer centers without passing through the suppliers' distribution centers, and "modal shift," in which transportation between some transfer centers is switched from trucks to marine shipping or railroads.

-

Reduction of GHG emissions when manufacturing productsScope3

Category1

The Shimamura Group purchases almost all of the products it sells from its suppliers and does not own our own factories or manufacture products. Nevertheless, we recognize that consideration for the environment throughout our supply chain is an important ESG issue.

Therefore, we established the Shimamura Supplier Code of Conduct (CoC) in 2019. Under that CoC, we are working to improve the environment in our supply chain in cooperation with our suppliers.

In order to certify PB product production factories, the staff from our Merchandise Management Department responsible for quality control visit factories. They then confirm the production control of those factories and evaluate the status of compliance with the CoC such as the consideration for the working environment and human rights of employees. We will further strengthen our environmental initiatives in the future. We will begin with the management of energy and water in factories from FY2023. In addition, we will introduce initiatives of excellent factories at briefing sessions for suppliers to improve the level of initiatives over the whole supply chain. -

Reduction of GHG emissions accompanying the disposal of products soldScope3 Category12

We thoroughly implement inventory management so that excess inventory does not arise to reduce our environmental burden. This means we do not dispose of products. On the other hand, we also recognize that the environmental burden of disposing of clothing products which are no longer used is an important ESG issue.

We also aim to achieve zero disposal of products after they are sold, and in June 2024 we implemented a clothing collection program at some of our stores.

-

Reduction of power consumptionScope2